Everything is upgraded with technology. Even transactions are now upgraded to electronic transactions. Electronic transactions means that you can transfer your funds online.

Moreover Mobile money is available from which you can transfer your money or additional money to other accounts. Some days come like Sunday, which is days off transactions for the bank. There you can use mobile money transfer.

But in the hardest time due to business reasons where you can’t take a risk to let your business info leak or you can say your bank details leak, a check is used.

In most financial institution, bank checks are used. Just like we use credit card or debit card in our daily routine, businesses use checks in their transactions.

In this blog, we’ll see what is the starting check number, what is its importance? etc. Let’s dig into the details.

What is Starting Check Number ?

In bank products, a check has its own value of importance. Besides electronic payments which can be performed from one of the banking products, banking app, check can be used too. The benefit is you can withdraw any amount you want. Of course, banking info is necessary for the person who is receiving it.

You can have a checkbook too if you ask your bank to issue it. Starter checks can be started from 1000 or 1001 or 0001 etc. They can also print checks in 10 or 1 format too.

If your physical check is starting from 1000 or 1001, you should consider yourself lucky. Because writing checks having numbers more than 3 digits known that this bank account is mature and old.

Starting check number is basically a number of your check in a check book. Just like a page of any story, newspaper starts from 0 or 1. You check book check’s start from any number which is basically a starting check number.

It can be 100, 1001 or 1110 too. The more check numbers in your check book, the older it is going to look which is best for taking record of your transactions.

What is Check in Starting Check Number ?

Check or bank check is basically a document which is used by a person who wants to deposit money from his own account to another person’s account. Banks produce checks in quantities but limited to the accounts they have opened.

Then can either issue free checks to customers or took charges of it. It depends on the bank. Checks are also used in current accounts too. Checking account plain is best before requesting check book from the bank.

You have to apply for a check book. It takes a couple of business days. Once you get your check book you can use it. There is electronic check as well which can be used to transfer money via ACH Network.

How do you order the First Check Book in Starting Check Number ?

Once you open your current account or checking account in a bank, they either issue you for free or take charges of it. You can get your check in 4 different ways.

Visit your Bank

You can visit your bank personally to request them. You can ask them to issue you check book. It will take 10-14 business days to proceed. They will deliver it to you.

Issuing check by phone call

You can also confirm the check by phone call on your bank’s phone number. You’ll have to provide your bank account number and routing number to the customer service representative.

Apply for Check Book Online

On mobile application (Mobile Money Bank) or online application, you can apply for check book. It’ll take 10-14 business days. Many banks these days offering this facility. You can order it if you can’t visit the bank.

Purchase it from Third-Party Vendor

You can purchase checks from the Third-Party Vendor. A preferred vendor from a concerned bank is better but you can purchase it from any Third-Party Vendor. It may cost a bit but you’ll have a penalty on designs besides the bank’s one.

Components of Check in Starting Check Number

Transferring money through physical check is still in practice and considered one of the most secure ways. People are using online banking and other possible banking products like debit card, credit card, online banking, mobile money etc.

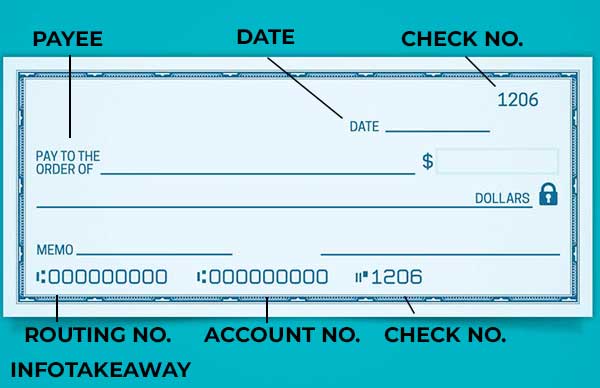

Bank checks still win the trust of account holders either they have current accounts or any other. There are a total 8 components of checks through which your transaction is made through check. We’ll explain each in detail.

Check book Holder Information

Check book holder, which owns the check book has its own information on the top left side of the check. It contains his full name and address. It can also contains bank’s information too in order to hide check book holder’s information.

Check Number

Check Number is mentioned on the top right corner of the check. It actually represents the number of checks in check book. A starting check number is the number of the first check in check book. It can be start from 100 or 1001 or even 10. You can ask your bank to start it from your desired digits.

But once your first check book is issued with the starting check number, another issued check book will start from the previous check number in order to maintain your bank checks record.

Date

Below the check number of your check date is mentioned. It is used to withdraw a check on the date mentioned on it. It can neither withdraw earlier or later than the date mentioned on it. It also saves you from fraudulent businesses too.

Amount in Digit

This section in the check book contains the information about how much amount you want to mention on the check. It isn’t the full and final amount. It is used as a reference we can say.

Let’s suppose an X.Y.Z current account holder has 150$ in his account. He gave a check to the Payee or Depositor by writing 155$ on it. Most banks check the figure of the amount written in words.

Amount in Word

This section in the check book contains the amount in words. It is the actual amount which is deposited to the payee / depositor’s account. A check owner writes it in words which is confirmed by bank staff.

Signature

This section contains the space where the signature is written by the check owner. Usually signature by the check owner is written once on the signature section while twice on the back of the check in order to cross check it.

Numbers

Below the check , you’ll see a three pair of numbers in groups. Each group have its meaning which we are going to discuss below:

Routing Number

The first pair of 9 numbers is called the routing number. It is also known as your financial institution number. It actually represents your bank. It is a unique number for every bank. On your check book, you’ll see the 9 digit number.

Account Number

Besides Routing Number, a 10 to 12 digit number is also mentioned their. It is known as account number. It represents your bank account number. In case you don’t remember your bank account number, you can check it from here.

Check Number

The last set of numbers is the check number. It usually contains a group of 4 digits. Initial checks may start with a number 1001 or 1000. You can also request your desired number on initial checks.

Which number is best for Starting Check Number ?

Most of the banks makes starting check number “1000” or “1001”. It makes your check account older and mature. There is no such issue regarding your checkbook’s starting check number. You can start it from anywhere you want. The policies for check acceptance required information we discussed earlier.

Your checkbook’s check number sequence is important in order for you to keep record of your deposit slip. When you apply for new checkbook, check number sequence starts from the previous one.

Let’s suppose your previous checkbook’s initial checks started from 1001 and ended on 1101. Your new check book’s check number sequence will start from 1101.

FAQ of “Starting Check Number”

Starter Checks have Starting Check Number?

Yes, your start checks contains starting check number sequence too because of policies for check acceptance. Some starter checks hide your personal information as well as clone check number. Stating check does not reveal your information.

Can I have a custom Check Book Starting Check Number?

Yes you can have a custom check book from a third-party vendor. The preferred vendor is Carousel Checks Inc.. It is one of the best companies producing personal checks

Carousel checks produce duplicate checks, personalized checks, single page checks even themed checks too. You can ask for additional checks with different check style.

Is it okay If my Starting Check Number is 1001 or 1000?

Yes it’s completely okay if your starting check number is 1001 or 1000. The quantity of checks contains check number and it can start from anywhere.

Can I Buy Check with my own Starting Check Number?

Yes you can buy check from any other third-party vendor too. Carousel checks Inc. is one of the best companies. You can buy a bundle of checks from this company.

Either it is single page checks, duplicate checks, themed checks, personal check or personalized check you can buy checks from this company according to your own check style. The entire check will have custom design.

This company will charge an amount for making custom checks. The check costs are not expensive.

Can I have online check?

Yes you can have online check if your banks gave you this option. Your entire check will be online. It usually comes in online banking. To use it, first you have to request your bank to give you access to this option.

Conclusion of “Starting Check Number”

Starting check number can be started from anywhere. The quantity of checks contains a check number sequence. You can buy checks from different companies. Carousel checks Inc. is producing checks with custom design. Policies for check acceptance are the same if your check book’s check number, routing number and account number are valid.

Buying checks is okay if you’re buying it from a well known company. Moreover your starting check number can be 1001 or 100 it really doesn’t matter.

What is the Starting Check Number?

If you’re going to issue a check book from your bank, you can book it from your phone, online or by visiting the bank. The thing comes up with the check number sequence. What should your starting check number be?

It can be anything but make sure to get it between 4 digits so your account looks mature. You can have duplicate checks if you want to keep records in the form of a copy.

I hope that you find this interesting and informative. If you have any questions or query, you can ask me in the comment section. I’ll be happy to answer you as soon as possible.

Besides this, I wrote other topics like “How much is a Pound Of Weed costs in the World? (Explained 2021)“, “What is Text Mail Subscriber? Is is Real or Fake? Explained [2021]” , “What is Payment Revision Method (Amazon) Explained” , “What is Lunk Alarm at Planet Fitness? Explained in Detail” , “What are Korean Beauty Standards? Explained“. Go check it out.